Life has a knack for throwing curveballs. A sudden car repair, an unexpected medical bill, or even a temporary job loss can quickly turn your world upside down, leaving you scrambling. That's where Building Emergency Funds & Financial Safety Nets comes in – it's your personal financial bodyguard, ready to step in when the unforeseen strikes. This isn't about hoarding cash; it's about intelligent preparation, creating a buffer that protects your peace of mind and keeps your long-term goals on track.

Think of it as the ultimate insurance policy for your everyday finances. It’s the difference between a minor setback and a full-blown crisis, between calm decision-making and panic-induced debt. Let's dig into how you can build this essential safety net, step by practical step.

At a Glance: Your Financial Safety Net Blueprint

- What it is: Money specifically for unexpected emergencies, not planned expenses.

- Why you need it: Provides security, prevents debt, offers peace of mind, and fosters independence.

- How much: Aim for 3-6 months of essential living expenses, starting with an achievable $1,000.

- Where to keep it: A separate, high-yield savings account that's easy to access but out of sight.

- When to use it: Only for true emergencies like job loss, medical bills, or critical repairs.

- After using it: Replenish it immediately to stay prepared.

The Unshakeable Truth: Why You Need an Emergency Fund

It’s easy to live in the moment, assuming things will always go smoothly. But history, both personal and global, reminds us that life is inherently unpredictable. An emergency fund doesn't just catch you when you fall; it prevents you from falling into deeper financial holes in the first place.

More Than Just Money: Peace of Mind

Financial stress is a heavy burden. Constantly worrying about "what if" can take a toll on your health, relationships, and even your professional life. Having a dedicated emergency fund acts as a profound stress reducer. Knowing you have a financial cushion allows you to breathe easier, confident that you can handle unexpected expenses without sacrificing your financial stability. Loretta Roney, CEO of InCharge, perfectly articulates this, noting that an emergency fund lowers stress, protects your budget, and maintains focus on long-term goals. That peace of mind? It's priceless.

Dodging the Debt Trap

Imagine your refrigerator suddenly stops working. Without an emergency fund, your immediate options are grim: put it on a high-interest credit card, take out a predatory payday loan, or simply go without. Any of these choices can plunge you into a cycle of debt that's incredibly hard to escape. An emergency fund sidesteps this entirely. You simply tap into your savings, fix the fridge, and move on. You avoid reliance on credit cards or loans for sudden expenses, effectively preventing high-interest debt from taking root.

Building Real Financial Security

Financial security isn't just about how much you earn; it's about how resilient you are when your income or expenses fluctuate unexpectedly. An emergency fund is your primary line of defense. It provides a safety net and funds to fall back on during setbacks, ensuring that a bump in the road doesn't derail your entire financial journey. It’s the difference between navigating a crisis with confidence and succumbing to its pressures.

Reclaiming Your Independence

Nobody wants to rely on others for financial help, especially during tough times. Whether it's asking family, friends, or even your employer for an advance, needing to seek assistance can feel disempowering. Your emergency fund grants you a crucial layer of financial independence. It ensures that when life throws a wrench in your plans, you have the resources to address it yourself, maintaining your dignity and control over your own financial destiny. It prevents you from needing to rely on others for financial assistance, empowering you to stand on your own two feet.

What Exactly Counts as an "Emergency"? Defining the Line

This is perhaps the most critical distinction to make. An emergency fund is a sacred cow – it's for unforeseen, urgent, and essential expenses, not for everyday whims or even anticipated costs. Misusing it can undo all your hard work.

The "Unexpected & Essential" Rule

An emergency is an event that significantly impacts your life or financial well-being if not addressed immediately. It's an expense you couldn't have predicted and one that is absolutely necessary to maintain your basic living standards or safety.

Examples: When to Use It

- Job Loss or Significant Income Reduction: This is often the biggest reason for an emergency fund. It covers your basic living expenses while you search for new employment.

- Major Medical Expenses: Uninsured doctor visits, hospital stays, or prescription costs that arise suddenly.

- Critical Home Repairs: A burst pipe, a leaking roof, a broken furnace in winter, or a failing water heater. These impact your health, safety, or ability to live in your home.

- Essential Car Repairs: If your vehicle is necessary for work or daily life, a sudden breakdown warrants using your fund.

- Urgent Travel: A sudden, necessary trip due to a family emergency (e.g., severe illness or death).

Crucial Clarification: When NOT to Touch That Fund

This is where discipline comes in. Remember, the fund is not for:

- Planned Expenses: That dream vacation, a new car, a home renovation you've been planning for months. These should be saved for separately.

- Discretionary Spending: New gadgets, dining out more often, impulse purchases, or concert tickets.

- Regular Bills: Rent, utilities, groceries, or mortgage payments. These are part of your regular budget. If you can’t cover these, it's a budgeting issue, not an emergency.

- Non-Urgent Maintenance: Getting your oil changed, routine dental cleanings, or repainting a room. These are either predictable or can wait.

The distinction is clear: if you could have planned for it, or if it's not absolutely essential to your immediate well-being, it's not an emergency fund expense.

How Much is "Enough"? Setting Your Emergency Fund Goal

The question every aspiring saver asks: What's the magic number? While there's a common guideline, the "right" amount is ultimately personal.

The 3-to-6 Month Guideline

Financial experts often recommend saving enough to cover three to six months of essential living expenses. For some, this might feel daunting, but let's break it down. "Essential" means what you must spend to survive: rent/mortgage, utilities, basic groceries, crucial transportation (gas, public transport), and essential healthcare costs. It doesn't include luxuries like dining out, entertainment subscriptions, or designer clothes.

Crunching the Numbers: Your Essential Expenses

To figure out your target, take a deep dive into your monthly spending.

- List all your monthly expenses.

- Highlight the absolute necessities: Rent/mortgage, minimum loan payments (student, car), utilities (electricity, water, gas, internet), groceries (not restaurant meals), essential transportation, insurance, minimum healthcare costs.

- Add these up. This is your "essential monthly cost."

- Multiply that number by 3, 4, 5, or 6. This gives you your target.

Example: If your essential monthly expenses are $2,500, a 3-month fund would be $7,500, and a 6-month fund would be $15,000.

Why the range? Your personal circumstances dictate the ideal amount:

- Job Stability: If your job is highly secure, 3 months might be sufficient. If your industry is volatile or you're self-employed, 6 months (or even more) offers greater security.

- Health: If you have chronic health conditions, a larger buffer for medical costs is wise.

- Dependents: More dependents typically mean higher essential expenses and a need for a larger fund.

- Other Debts: If you have significant debt, having a robust emergency fund ensures you don't default on those payments during a crisis.

Starting Small, Thinking Big: The Power of $100

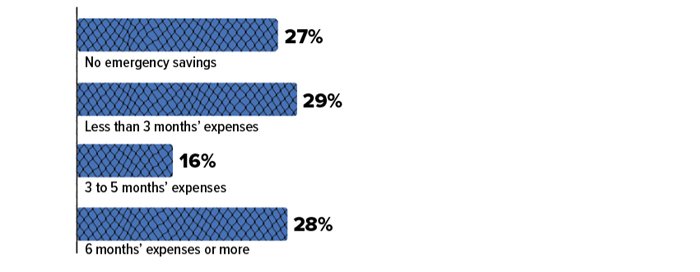

For many, the idea of saving thousands of dollars feels impossible, especially when living paycheck to paycheck. Statistics back this up: nearly a quarter of Americans lack an emergency fund, and only 46% have enough for three months of expenses. But here's the secret: start small.

Begin with a realistic, achievable goal. Can you save $100? Or $500? The first milestone should be something attainable that builds momentum. Many experts suggest aiming for $1,000 as a fantastic initial goal, often enough to cover smaller emergencies without significant stress. Saving about $21 per week, for instance, can accumulate over $1,000 in a year – a truly impactful first step. Remember, the goal is to build security without financial strain, and starting small is always better than not starting at all.

Your Step-by-Step Blueprint: Strategies to Build Your Fund

Now that you understand the "why" and "how much," let's get down to the "how." Building an emergency fund requires intention and consistent effort, but these strategies make it manageable.

Step 1: Make it a Priority in Your Budget

This is non-negotiable. If you don't tell your money where to go, it will mysteriously disappear. Creating a budget is your roadmap.

- Track Your Spending: For a month or two, write down every dollar you spend. Apps, spreadsheets, or even a notebook work. This reveals where your money is actually going versus where you think it's going.

- Categorize & Allocate: Assign specific amounts for different categories (groceries, housing, transport, entertainment, savings).

- Prioritize Savings: Before you pay for anything else (after essential bills), allocate a portion to your emergency fund. Treat it like a bill you must pay. Even $20 or $50 consistently adds up. Look at your budget, set a specific savings goal, and make those regular contributions a priority.

Step 2: Create a Dedicated, Out-of-Sight Account

Your emergency fund needs its own home, separate from your checking account or everyday savings. This isn't just about organization; it's psychological.

- Open a Separate Account: Choose a separate savings account, ideally at a different bank or credit union, or at least one not linked to your debit card. This prevents accidental spending.

- Set Up Automatic Transfers: This is the golden rule of saving. Schedule a recurring transfer from your checking account to your emergency savings account on payday. Even a small, consistent amount like $50 every two weeks will grow steadily. This ensures consistency and prevents you from "forgetting" to save or using the fund for non-emergencies.

Step 3: Trim the Fat: Finding Money You Didn't Know You Had

Review your spending habits with a critical eye. Where can you cut back without severely impacting your quality of life?

- Cut Back on Non-Essentials:

- Dining Out: Packing lunch once more a week or cooking at home a few extra nights can save hundreds over a month.

- Subscriptions: Review all your streaming services, gym memberships you don't use, or app subscriptions. Cancel what you don't actively use or need.

- Impulse Purchases: That extra coffee, the item in the checkout line, the online shopping spree. Be mindful.

- Entertainment: Find free or low-cost activities.

- Shopping: Can you buy generic brands? Do you really need new clothes or electronics right now?

- Sell Unused Items: Declutter your home and make some cash. Old electronics, clothes, furniture, or collectibles can be sold online or at a yard sale. Every dollar earned goes straight to the fund.

Step 4: Supercharge Your Savings with Unexpected Windfalls

Life occasionally hands you extra cash. When it does, resist the urge to spend it and funnel it directly into your emergency fund.

- Tax Refunds: This is a common and often substantial windfall. Resist the urge to splurge; allocate your tax refund to the fund.

- Bonuses or Commissions: If your job offers performance bonuses, direct a significant portion to your savings.

- Gifts: Birthday money, holiday gifts from family.

- Small Wins: Reimbursements, rebates, or even found money. Any unexpected cash is an opportunity to boost your fund.

Step 5: Make Your Money Work for You

Once you have a decent sum, ensure your emergency fund is growing, even if slowly.

- High-Yield Savings Account (HYSA): Instead of a traditional savings account with negligible interest, opt for a high-yield savings account. These often offered by online banks, offer significantly higher interest rates, helping your money grow faster with minimal effort. While not a get-rich-quick scheme, every little bit helps. Make sure it’s FDIC-insured.

Step 6: Tackle Debt (Carefully!)

This strategy might seem counter-intuitive when discussing savings, but high-interest debt can be an emergency in itself. While building an emergency fund, you should also evaluate your existing debt and make a plan to pay it off.

- The "Baby" Emergency Fund: Many experts suggest saving an initial $1,000 emergency fund before aggressively tackling debt. This small buffer prevents new debt if a minor emergency arises during your debt repayment journey.

- Debt Repayment Methods: Once you have that initial buffer, you can prioritize debt.

- Debt Avalanche: Pay off debts with the highest interest rates first. This saves you the most money over time.

- Debt Snowball: Pay off the smallest balance first to gain psychological momentum.

- Professional Help: If debt feels overwhelming, non-profit credit counseling agencies, like FCAA member organizations, can offer invaluable support. They can help you create a budget, manage your debt, and establish an emergency fund plan, contributing to your overall financial stability. Sometimes, understanding a dollar short, a day late is the first step towards getting the right kind of support.

Overcoming the Hurdles: Common Challenges and Solutions

Building an emergency fund isn't always easy. Life gets in the way, and temptation is constant. But recognizing these challenges is the first step to overcoming them.

Living Paycheck to Paycheck: Every Dollar Counts

When every dollar is spoken for, finding extra to save feels impossible.

- Solution: Start microscopic. Even $5 or $10 a week is a start. Focus on those small cuts: one less coffee, one less impulse buy. Over time, those small, consistent amounts truly accumulate significantly. Remember the $21/week to $1,000 in a year example.

- Solution: Look for opportunities to earn extra cash: freelance gigs, selling crafts, dog walking, babysitting. Every extra dollar goes directly into the fund.

The Urge to Spend: Discipline and Delayed Gratification

That money sitting in your savings account might feel like "found" money for a fun purchase.

- Solution: Keep the account out of sight and separate. The harder it is to access, the less likely you are to tap it for non-emergencies.

- Solution: Remind yourself of the "why." Write down your reasons for building the fund and keep them visible. Imagine the peace of mind during a crisis.

- Solution: Practice delayed gratification. Before a non-essential purchase, impose a 24-48 hour waiting period. Often, the urge passes.

Staying Motivated: Celebrate Milestones

Saving can feel like a long, arduous journey.

- Solution: Break down your ultimate goal into smaller milestones ($100, $500, $1,000, 1 month of expenses).

- Solution: Reward yourself (modestly!) when you hit a milestone. A nice coffee, a movie night, something that doesn't derail your savings but acknowledges your hard work. This keeps you engaged and motivated.

The Lifeline is Used: Now What? Replenishing Your Fund

So, you had a genuine emergency, and your fund saved the day. Congratulations – it worked exactly as intended! But the job isn't over.

- Prioritize Replenishment: As soon as the immediate crisis is handled, your top financial priority should be to replenish your emergency fund. Treat this with the same urgency as building it initially.

- Adjust Your Budget (Temporarily): You might need to temporarily cut back on even more discretionary spending to rapidly rebuild your fund.

- Maintain Automatic Transfers: Keep your automatic transfers going, and if possible, increase them until your fund is back to its target level.

Remember, the goal is always to have that safety net fully deployed and ready for the next unexpected event. You never know when it will be needed again.

Your Journey to Financial Resilience: Taking the Next Step

Building an emergency fund isn't just a financial strategy; it's an act of self-care. It’s an investment in your future self, protecting you from the inevitable bumps in the road and empowering you to face life’s challenges with confidence. It’s a cornerstone of true financial health, fostering security, independence, and priceless peace of mind.

Start today. Even if it's just $20, make that first transfer. Set up that separate account. Begin tracking your expenses. You'll be amazed at how quickly those small, consistent steps transform your financial landscape. If you're feeling stuck or overwhelmed, remember that resources are available. FCAA member credit counseling agencies, for instance, are dedicated to helping individuals build budgets, manage debt, and establish robust emergency funds, guiding you toward greater financial stability and independence. Your financial safety net awaits.